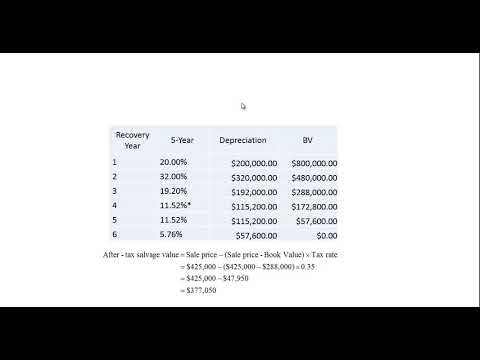

In this video, I want to discuss the MACRS depreciation method, which stands for modified accelerated cost recovery system. It is the current tax depreciation system in the United States. Under this system, the capitalized cost or the basis of the tangible property is recovered over a specified life by annual deductions for depreciation. The lives are specified broadly in the Internal Revenue Code. What it does is it allows firms to recover the costs of capital equipment faster than the straight-line approach. In a previous video, I've discussed straight-line depreciation, which is simply deducting the same amount every year. Here, you're going to deduct more in early years and less in later years. One thing to note that's different about MACRS versus the straight-line approach is that the salvage value is not deducted when doing the calculations. It seems to be a common mistake that is made when people do the depreciation schedule. Alright, right here, I'm going to show you an example of some of the property classes. There are actually more, but I couldn't squeeze them all into a slide that would be readable on the video. Okay, there's three-year property and some of the things that fall under three-year property are special handling devices for food and beverage manufacturers, special tools for the manufacturer of finished plastic products, etc. There's five-year property, such as information systems like computers and peripherals, petroleum drilling equipment, etc. The IRS specifies what table you should use for the depreciation, so you don't make it up. You don't decide, "Okay, I'm going to use five years for my other office furniture." No, they say that seven-year property, so you have to go with whatever they tell you should be using. This is what the table looks like. Again, I've only shown...

Award-winning PDF software

4797 calculator Form: What You Should Know

Income Tax Credit Additional Due Diligence FAQs Ask Your Question at IRS Call Center Jul 23, 2025 — Do. Your. Taxes. Today. Call to speak with a taxpayer representative. · If the taxpayer has self-employment income. CTC, ETC, or ATC Questions at IRS Call Center Is it the CTC or ETC, and do you still need documentation to obtain it — (Wins) and EIN cards, if needed? • If you're a small business owner (less than 500 gross payroll) · If under age 59 ½ How to Check Tax Year, Tax Type Nov 19, 2030 — If you are filing a return for the year... · Did you itemize for tax year 2016? Do any of these situations prompt you to ask more questions? • Is the return a joint return and a spouse claimed the ETC? Does the husband claim the ETC? • Do you use a client intake sheet? · Do you have any documentation to substantiate the business? • If this is a joint return and your spouse does not claim an ETC, did you do any of the following? Check to see if you received your tax withholding notice from your HHS. Did you pay, or expect to pay, income tax on any of the following: • Unearned income you received from any source such as alimony, wages, annuity or trust income? Tax-deferred or tax-free distributions from certain qualified retirement plans? Income Tax Credit Additional Due Diligence Questions Tax Type Change Due Diligence Nov 3, 2031 — How do you change the income tax type from the one you had reported on your return for the previous year? • Check to see if you received any IRS Taxpayer Bulletin — T2612, Tax Bulletin on Estates and Trusts. Form 8867, Paid Preparer's Due Diligence You should always keep complete copies of this form, a list of questions to ask.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4797, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4797 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4797 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4797 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4797 calculator