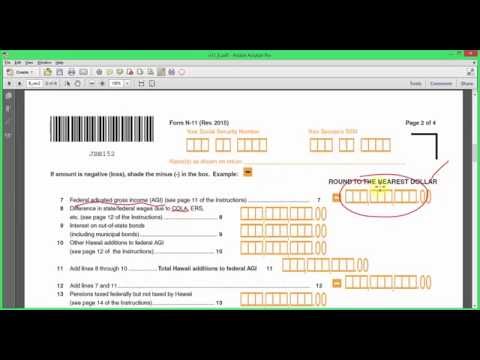

In this short video, I want to go over some of the differences between reporting income on the Hawaii income tax return compared to the federal US income tax return. The first dollar amount entered on the Hawaii and eleven form is really on page two. Let's zoom in on the first dollar amount, which is the federal adjusted gross income. You pretty much have to complete your federal return before you can complete your Hawaii return. Looking at the federal return, the income should be reported here and some deductions called adjustments should be subtracted from the gross income to get the AGI. They adjust the gross income for federal here at the bottom of the 1040 form, and you would rewrite it here on line 7 of page 2 up to n 11. Not all of the income and deduction rules are the same when comparing Hawaii and US tax laws. So, in this part right here, we're going to increase the federal adjusted gross income for income that's taxable to Hawaii but not taxable on the federal return. For example, if you're a federal civil service worker here in Hawaii or maybe in Alaska, you know that the cost of living is much higher compared to the regular mainland states. So, those federal workers get something called a cost-of-living allowance, and it's a tax-free benefit only for federal income taxes. If that COLA allowance is not included in the federal aid but is taxable for Hawaii, you have to add that in line 8. Because of this adjustment, it may affect other numbers on the Hawaii return compared to the amounts being reported. For example, state income tax reductions and state refunds may need to be adjusted because of this COLA, either in the current year or...

Award-winning PDF software

Video instructions and help with filling out and completing Why Form 4797 Refunds