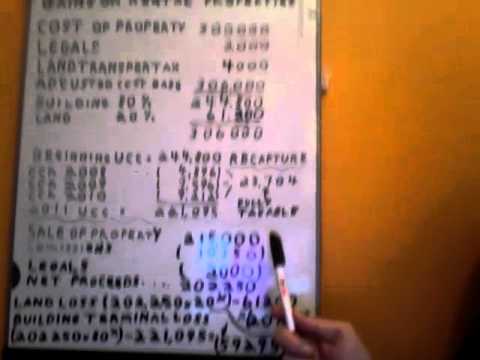

Hi Peter Russell here from Super Taxi. Welcome to another one of my video blogs. This is a continuation of my walkthrough of an example of a capital gain on the disposition of a rental property. Now, in this example, we are changing a bit of the terms. Instead of making money on the disposition of our rental property resulting in a capital gain, we are actually incurring losses on the sale of our rental property in this example. So, I am going to swing over to the big board. Now, you've probably seen this example before in the last video. It's pretty much the same figures. We're going to COD John's calculated ACB of his properties - $306,000. We're still splitting 80/20 building and land. So, our beginning UCC for our building is still $244,800, and the land's ACB is still $61,200. We're still selling in 2010, and we still have a UCC at the start of 2011 of $221,095. Now, instead of selling for $450,000, we have sold the home for only $215,000. Maybe the market was bad or for whatever reason, we could not sell this property for more than $250,000. It cost us $10,750 in commissions and $2,000 in legal fees. So, our net proceeds are $202,250. We've definitely lost money this time. Now, we've got to determine our capital loss on the land portion and what we call a terminal loss on the building portion. So, to start with the land, what we would do is take $202,500 (our proceeds) times 20% and subtract our calculated ACB of $61,200, giving us a capital loss of $20,750. This capital loss can be carried forward indefinitely or carried back against taxable capital gains for three years. Now, for the building portion, we're going to end up with something called...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 4797 Reduced