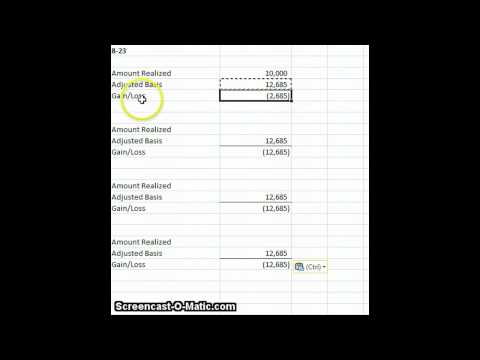

Okay, we're going to do an example problem from Chapter eight and applications 23 on page 228 of the book. In this case, we have firm OCS that sold business equipment with a twenty thousand dollar initial cost basis and seven thousand three hundred fifteen accumulated depreciation. In each of the following cases, we need to compute OCS's recaptured ordinary income and section 1231 gain or loss on the sale. Okay, let's start with our first case, number a. The amount realized in our sale was ten thousand dollars. Our adjusted basis is going to be equal to our cost of twenty thousand minus our depreciation of seven thousand three hundred and fifteen. Therefore, our adjusted basis is twelve thousand six hundred and eighty-five. I am going to copy that down because it will not change throughout. So, our gain or loss in this first case is two thousand six hundred and eighty-five, and this will be a section 1231 loss. We can deduct this loss. Moving on to Part B, our amount realized is thirteen thousand. This results in a three hundred fifteen dollar gain. Now, how is this going to be classified? Is it going to be a section 1231 gain or a recapture of ordinary income? According to our rules, we know that we have to net section 1231 gains against ordinary income deductions due to depreciation. Therefore, this gain of three hundred fifteen dollars will be considered recaptured ordinary income to offset the amount we took as depreciation. In case C, we had a realized amount of seventeen thousand five hundred dollars, which gives us a gain of four thousand eight hundred fifteen dollars. Again, this will be a recaptured ordinary income. As a reminder, we need to classify our gain as ordinary income until we have recaptured the...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 4797 Gains