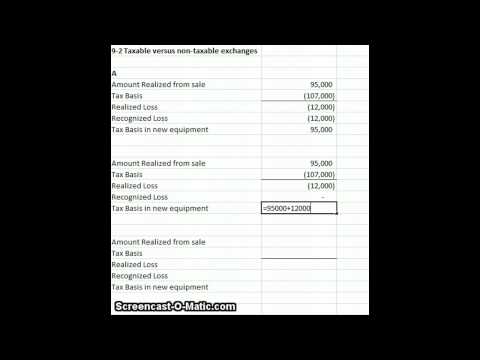

Okay, we are doing an example problem from chapter 9. It is under application problems number 2 on page 253. It involves a business called K exchanging old machinery with a fair market value of $95,000 for new machinery, which also has a fair market value of $95,000. The business's tax basis in the old machinery is $107,000. In Part A, we need to compute the business's realized loss and tax basis in the new machinery, assuming the exchange is a taxable transaction. Since it is a taxable transaction, the amount realized is $95,000 and the basis is $107,000. This means that the realized loss is $12,000, which is also the recognized loss. The new tax basis for the equipment will be the fair market value of $95,000. In Part B, we need to compute the realized loss and tax basis in the new machinery, assuming the exchange is a non-taxable transaction. In this case, the non-taxable amount realized is $95,000 minus the cost basis of $107,000, resulting in a loss of $12,000. However, since it is a non-taxable transaction, we defer the recognition of this loss. Therefore, the new tax basis for the equipment is the realized amount from the sale, $95,000, plus the deferred loss of $12,000, totaling $107,000. Finally, we have six months after the exchange where business K sells the new machinery for $100,000 in cash. If the exchange was taxable, the amount realized from the sale is $100,000. Since the original tax basis in the equipment was $95,000, the gain recognized is $100,000 - $95,000, resulting in a realized gain and recognized gain of $5,000. If the exchange was non-taxable, we start with the amount realized from the sale, which is $100,000. The tax basis in the non-taxable exchange is $107,000, as we did not recognize the prior...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 4797 Exchanges