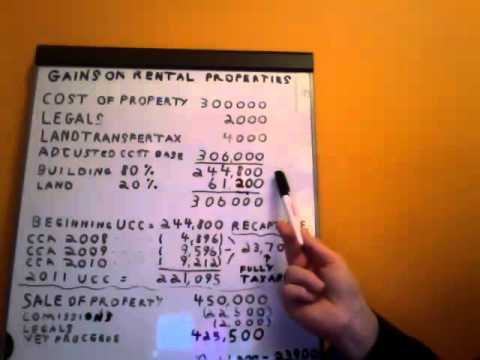

Hi there, I'm Peter Russell from Super Tacks. Welcome to another one of my video blogs. Today's discussion is a walkthrough of an example of a capital gain upon disposition of a rental property here in Canada. Now, essentially individuals get involved with rental properties to earn rental income and eventually earn a capital gain upon disposition of that rental property. Net rental income is generally your rental revenue earned less rental expenses. Rental expenses such as property taxes paid, mortgage interest paid, utilities, and repairs and maintenance are the general ones you're going to come across. Now, you can also take what is called CCA or capital cost allowance. That is basically the write-off of the cost of your rental property over time. How we do this is we set up the asset in what is called a class. Rental properties are generally put in class one for tax purposes here in Canada. Class one means that your decline you are writing off the asset at a declining rate of 4% per year. Now, here in Canada, we have something called the half-year rule, which means you only take half a decreased half of the depreciation in the first year that you generally would. So, in this example, if our rental property had a value of $300,000 and we take 2 percent the first year and then 4 percent on the 300,000 less 2% for the second year, I'm going to show you how this works in my example because this will help explain to you a topic which is called recapture, which is involved in the calculation of the capital gain of a rental property. Now, let's go visit my big board here where we have an example gains on rental properties. Okay, for my example, we're going...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 4797 Allowance