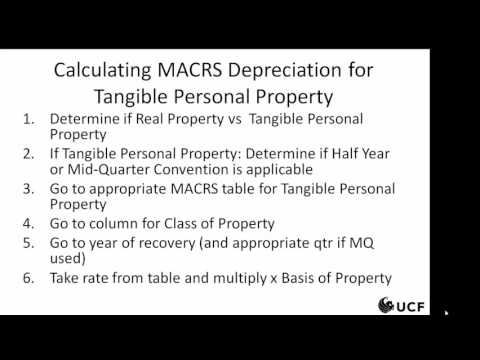

Welcome, my name is Marci Hampton and I'm a faculty member at the UCF Dixon School of Accounting. In this short lecture, I am going to talk about makers depreciation. This video is video two of a three-set video. In this video, we will talk about makers depreciation for tangible personal property. When doing makers for tangible personal property, the first thing we want to look at is what are the preset classes that we have. Preset classes for tangible personal property are 3, 5, 7, 10, 15, and 20-year property. The preset class is determined by the type of property that we're talking about. For example, vehicles are five-year property and furniture and fixtures are seven-year property. The next thing we look at is what method is used to calculate makers for tangible personal property. The method that's used is declining balance, mostly double or 200% declining balance. But it is 150% declining balance for 15 and 20-year property. The conventions that we use are so that we'll have tables that everybody can use to enable us to calculate our partial year for the first year and the final year. In this case, we have two possible conventions to handle the partial year for the first and the final year. The first convention is the half-year convention. Regardless of when during the year that you actually place the asset in service, we're gonna treat it as if it was placed in service halfway through the year. This way we get half a year's depreciation in the first year and a half-year depreciation in the final year. This way we can build it into the tables and enables us to use the tables with rates that everybody can use everywhere. In addition, taxpayers are told to switch to straight-line depreciation...

Award-winning PDF software

Video instructions and help with filling out and completing Which Form 4797 Tangible