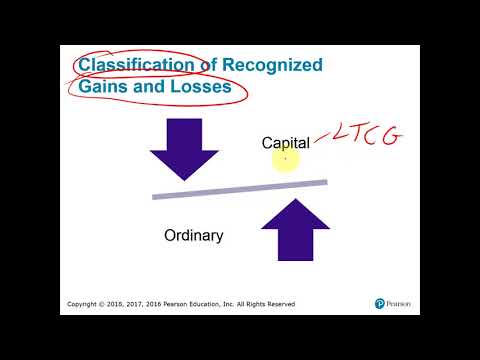

Here in Chapter 13, we are learning an extension of what we had learned back in Chapter 5 regarding the calculation of capital gain or loss. However, in Chapter 13, we are not selling or disposing of capital assets. Instead, we are dealing with section 1231 assets, which are basically business assets that are being disposed of. This disposal may result in a gain or loss, which could be treated as a capital gain, an ordinary gain under recapture rules, or an ordinary loss. To summarize this chapter, we are selling or disposing of section 1231 assets. If there is a gain, it is best to tax it at low rates, such as the long-term capital gains rates of 0%, 15%, or 20%, depending on the taxpayer's marginal tax rate. For business assets, section 1231 assets are generally fine, and in the next slide, we will discuss how to handle them when selling them at a gain. If the gain is long-term, it will be taxed as a long-term capital gain at lower rates. However, part of the gain may need to be treated as ordinary income if it is recaptured by deducting 1231 losses as ordinary losses in previous years. There is also something called recaptured section 1250, which applies mainly to real estate, and it is taxed at regular rates, with a maximum rate of 25%. Another type of gain is recaptured section 1245 and 1250, which turn the gain into ordinary income. Section 1231 losses, on the other hand, can be used to offset all types of income. This allows the taxpayer to benefit from both the capital gain treatment at low rates and the ordinary loss treatment for all types of income. However, if there is some type of recapture or on recaptured section 1253, the...

Award-winning PDF software

Video instructions and help with filling out and completing Which Form 4797 Losses