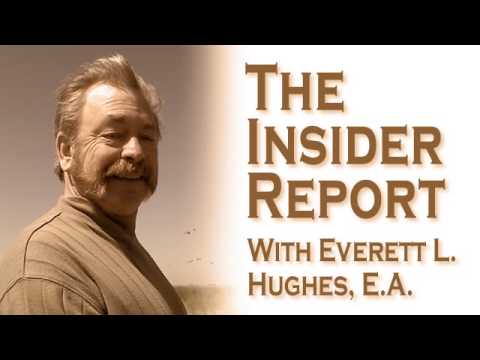

P>It's kbk double used coffee talk on FM 94 7 and a.m. 1450 and L. Let's go to Everett Hughes for the insider report. Good morning, Everett. Today, we are still inside the Schedule A and we're gonna look at another one of the three or four farms that are close to the Schedule A. You know, you've heard if you have a casualty step or loss, it might be deductible on your tax returns. Ah, have you heard that just now? Yes, but I hear about it a lot during tax season because everybody's heard about it, and they want to know if they can do it. Well, this form is a form 4684, and it flows right into line 20 of the Schedule A. It's the casualty theft we are worksheet, and there are two different kinds of casualty losses. One is business, which is pretty much 100 percent, and the other one is reduced by 10 percent of your adjusted gross income minus another 100 dollars. Here's what you have to do on the form 4684. You have to start with a description of the casualty or theft. You have to put in when the twin the theft or casualty started. Then you have to tell what kind of property it was. Was it personal or business employment or income-producing property? You have to check that. You have to check all these other categories. Was it used in a passive activity, and so on and so on it goes. Already, people are saying, "Well, I don't know." Now, if you've had the loss of the personal residence, there's a part of this schedule you have to fill out regarding that. Then you have to fill out whether or not the casualty was repaid by any form of...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 4797 Worksheet