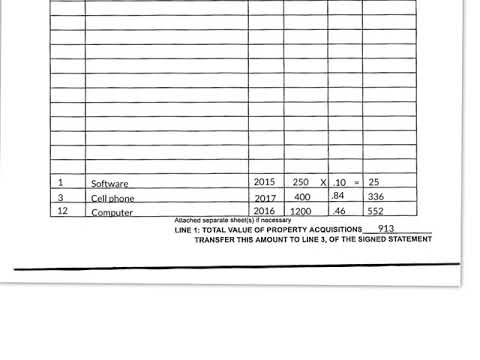

This video will show you, as a new business owner, how to fill out the Davis County personal property signed statement. Please note that this statement is due on May 15, 2018. If this is submitted after May 15th, 2018, you will incur fees and penalties. If your business is closed or never got started, please contact our office at 801-513-249 and let the person know that your business no longer exists. Because you are a new business, line one will be zero. Please do not alter this amount. On line two, you will enter the cost of supplies for one month. This amount can be determined by taking the total cost of supplies on hand for the year and dividing it by twelve. Supplies on hand include all office supplies, replacement parts, maintenance supplies, lubricating oils, fuels, and consumable items not held for sale in the ordinary course of business. Inventory items are not included in this example. Our annual supply amount was three hundred dollars. If you divide that by twelve, you will get $25 as the monthly supply amount, and the $25.00 will be listed on line two. On line three, you will list all of your assets. You will do this by completing Schedule B, which I will show you later on in this video. In Schedule B, you will list all of the assets used to run your business. Assets include, but are not limited to, furniture, software, computer, signs, uniforms, tools, phones, alarm systems, etc. Home businesses may use many assets which are owned personally. These items need to be reported. For each item, we will determine the property class by looking at the classification guide and the percent good schedule. We will show you how to do this on the next slide. Because you are a...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 4797 Tangible