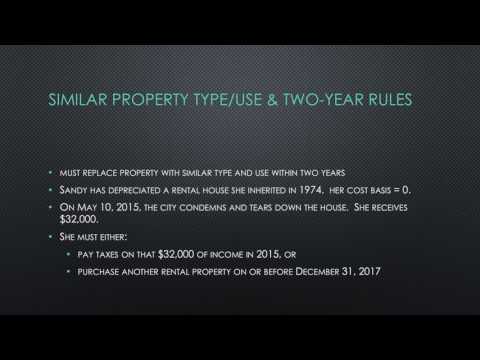

Hi, I'm Jeff Lovell, a staff accountant with a accounting[delete duplicate "a"] firm. Today, we're talking about the tax benefits and rules related to involuntary conversions. An involuntary conversion is damage, destruction, theft, or condemnation of property that results in reimbursement, usually through an insurance claim or a condemnation award. Such reimbursements are taxable. The gain or loss that you report is the difference between the payment you receive and your original cost basis. This is what you originally paid for the item, minus any depreciation you might have taken. If your cost basis is small and the payment is big, the difference is a gain. If your cost basis is large relative to your payment, the difference is a loss. The loss must be reported in the year it happened, but you can choose to report the gain now or in the future. The procedure for electing to defer the gain is to first not report the gain on your tax return and second, attach a statement which includes an explanation of the conversion event, the amount of the reimbursement you receive, your original cost basis, the gain being deferred, and a statement that you will be purchasing replacement property within two years. If you use this provision and follow the rules, you will not pay tax on the gain until you subsequently dispose of the replacement property. There are a number of rules that must be followed. The first is that you must replace the property with that of a similar type and use, and do so within two years. Let's work off of an example. Sandy has fully depreciated a rental house she inherited in 1974. This means her cost basis is now zero. On May tenth of 2015, the city condemns and tears down the house....

Award-winning PDF software

Video instructions and help with filling out and completing What Form 4797 Conversions