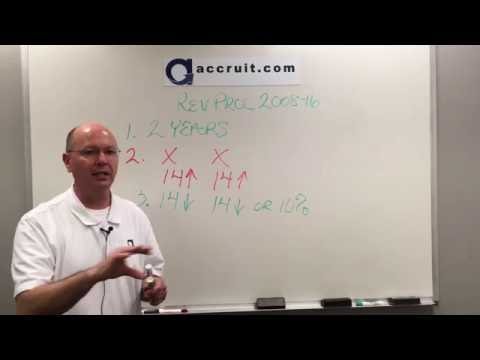

Welcome to 10:31 University. I'm Paul Holloway. Today's topic is: Is it possible to do a 1031 exchange on a second home or vacation home? Most 1031 exchanges are done on pure investment properties, such as rental properties or commercial buildings. But what about a vacation home or a second home in a resort area? Is it possible to make that work under 1031? The answer is yes, as long as you follow Revenue Procedure 2008-16. This procedure provides guidance on how to have a safe harbor exchange for a second home or vacation home. There are three tests you need to pass to qualify for a 1031 exchange on a second home. The first test is the holding period test. The IRS requires you to own the property for a minimum of two years before selling it or buying a replacement second home. The next test is the rental test. In each of the two years of ownership, you must have at least a 14-day rental history. This means you need to rent out the property for 14 or more days in each year. The final test is the personal use test. The IRS wants you to keep your personal use of the property to a minimum during the first two years of ownership. They suggest keeping it under 14 days per year or 10% of the rental history, whichever is greater. If you meet all three tests, you can have a safe harbor vacation home or second home 1031 exchange. It is important to note that family members using the property also count towards your personal usage. To summarize, hold onto the vacation home or second home for at least two years, have a rental history of at least 14 days in each year, and keep personal use...

Award-winning PDF software

Video instructions and help with filling out and completing Form 4797 Exchanged