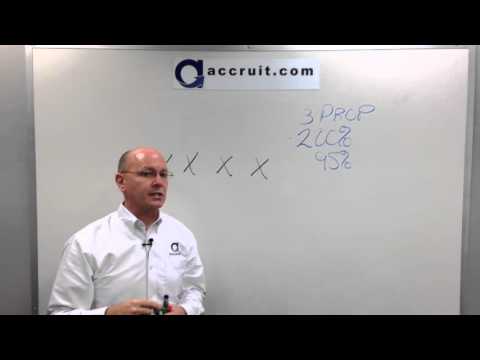

Welcome to 10:31 University. I'm Paul Holloway. Today, we are going to discuss the identification process under section 1031 of the tax code, specifically the three sub-rules under the identification process. These sub-rules are referred to as the two hundred percent rule, the 95 percent rule, and the three property rule. For those of you who are new to section 1031, it is important to understand that once you sell an investment property, the IRS gives you 45 days to identify up to three potential replacement properties, commonly known as the three property rule. To comply with the three property rule, you must send your identification list, consisting of no more than three properties, to your intermediary. The fair market value of each property does not matter to the IRS. It does not matter if they are worth trillions of dollars. However, what if you need to identify more than three properties? In that case, you must follow another sub-rule known as the two hundred percent rule. Let's say a taxpayer wants to identify four properties. In this situation, they would have to assign a fair market value to each property. For example, let's assume all four properties are valued at $100,000 each. Under the two hundred percent rule, the total combined fair market value of the four properties must stay below two times the amount the taxpayer sold their front-end property for. If the 200% threshold is not exceeded, the taxpayer can proceed and purchase one, two, three, or all four of the identified properties to complete the exchange. Now, let's change the scenario. Assume each property is valued at $300,000. The total value of all four properties would add up to $1.2 million, which exceeds the 200% threshold of $800,000. In this case, the taxpayer would have to follow the third...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 4797 Theyre