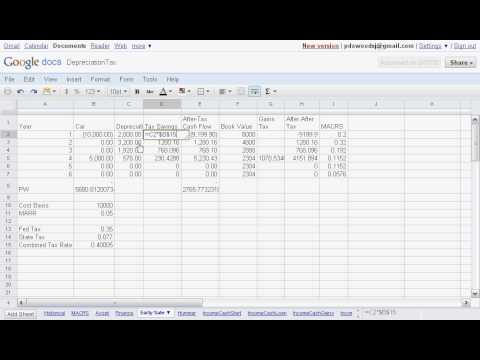

Let's expand on the example that we had of purchasing the vehicle. We're going to sell it before it becomes fully depreciated. The important point is that we will sell the car for something other than its book value. Depreciation is the formulaic way of determining how the car is losing value over time. When you make a transaction, you find out the actual worth of the car. If the book value and sales price are the same, it's a miracle. We start with a $10,000 car as our cost basis. We're dealing with a minimum acceptable return of 5%, 35% federal tax rate, and 7.7% state tax rate. To get the combined tax rate, you add up the state and federal rate and subtract the difference between the two. Let's look at the cash flow. The $10,000 is the cost of purchasing the vehicle. We plan to sell the car for about $5,000 in the fourth year. Depreciation is calculated by multiplying the cost basis of the car at $10,000 by the percentage in the modified accelerated cost recovery system table. In the first year, depreciation is $2,000. It's $3,200 in the second year. The pattern continues until the year of sale, where half of the depreciation is taken. The tax savings from depreciation are calculated by multiplying the depreciation amount by the combined tax rate. After-tax cash flow is obtained by adding the tax savings to the pre-tax car value. Depreciation recapture comes into play when you sell the car for less than its book value. Ordinary gains and losses are considered rather than capital gains. Book value is calculated by subtracting depreciation from the cost basis. For example, in the first year, the book value is $8,000. The book value decreases each year until it reaches $2,304...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 4797 Recapture