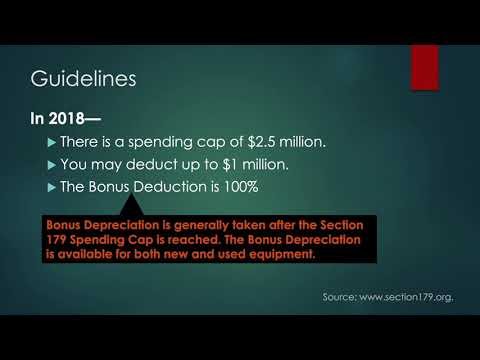

Hello, thank you for joining me for another on-demand training video. Our topic today is Section 179. What is that, you ask? Well, Section 179 is the shorthand for business tax deductions on property. With 2018 drawing to a close in just over a month, now is the time to consider any equipment your small business should purchase to maximize this year's Section 179 benefits. More details on that shortly. First, let's take a look at our roadmap for this session. Here's what we'll be covering: - Fast Facts: If you're pressed for time and don't want specifics, watch through this part of the presentation. However, of course, I suggest you stick around for the fuller details, including what is Section 179, what are the benefits, what are the guidelines for 2018, what kind of property is eligible, and the resources where can I learn more. Fast facts: Here are the bare-bones basics. Section 179 is a tax code created to help businesses. It's valid on most types of equipment and can greatly help your bottom line. It's simple to use, but it must be used by the end of the year for this year's benefits, and it can change from year to year. Now, let's dive into the details. So, what is Section 179? Here's the gist. Section 179 of the United States Internal Revenue Code allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense rather than requiring the cost of the property to be capitalized and depreciated. Now, let's highlight and explain some key terms in this paragraph. First, deduct. These are the subtractions you can take from your taxes to lower your annual bill. Next, certain types of property. There are many types of property costs that can...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 4797 Mileage