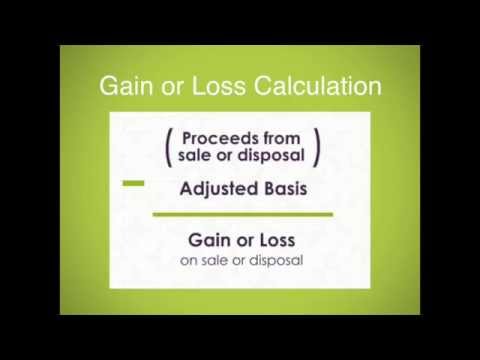

In this talk, I'll go through the general calculation of a gain or loss for when you sell something. An asset is something of value that you own. There are different categories for tax purposes because that's how the rules are defined. Based on the different categories, when you sell a property, the amount you receive as payment is called the sale price. In taxes, it is referred to as the proceeds from the sale. Usually, the sale price is the cash you receive for selling the item. However, this amount also includes everything of benefit that you receive for the property. For example, if the buyer assumes a loan that you had on the property, this amount is included in the sales price. Additionally, if the buyer trades you items or services for the property, the fair market value should be included as the proceeds as well. If you'll receive payments over multiple tax years, then still include the total amount as the sales price. But keep in mind that interest income must be accounted for as well. You can refer to my video on installment sales for more information. Now, if you dispose of an asset without selling it, you may have zero proceeds. However, if you receive any amount for disposing of the property, such as scrapping metal, include that amount as the proceeds. To calculate the gain or loss on the sale of property, you subtract your adjusted basis in the property from the total sales price. In general, the adjusted basis is the cost basis, which is what you paid to buy the item. The cost basis can be increased by expenses you paid to get the asset ready for its intended use, such as shipping costs and installation costs. Additionally, there are detailed rules...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 4797 Edition