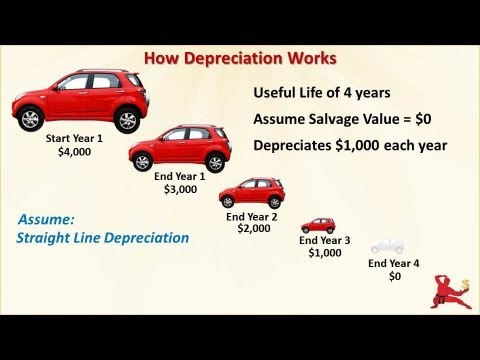

This text needs to be divided into sentences and corrected for mistakes. Here is the corrected version: Hi, I'm Sue Ling Hui, principal and founder of Cash Flow Gum Fool. In this video, you will learn what depreciation is and how it affects your business's finances, particularly profit and cash flow. Depreciation applies to fixed assets on your balance sheet. This group of assets is also called Property, Plant, and Equipment (PPE&E) for short. These are items that you buy to use in your business to help generate income for more than twelve months. Examples of fixed assets include land and buildings, plant and equipment, furniture, fixtures and fittings, computers, motor vehicles, trucks, and so on. The word "fixed" doesn't mean that they're not physically movable; it means they are part of your long-term business assets, which is why they fall in the non-current assets part of your balance sheet. Whether an item is a fixed asset or not depends on what it is used for in the business. For example, a car dealership buys and sells cars to generate income. These cars are bought by the business for the purpose of selling them as quickly as possible at a profit, so they are part of the business's stock or inventory. The dealership would also have its own cars for use by the business, and these cars would be part of the business's fixed assets. It's the business purpose of the item that determines whether it's part of inventory or fixed assets. All fixed assets have finite useful lives, except for land. Depreciation is an accounting concept that spreads the cost of a fixed asset over the term of that asset's useful life. The length of the useful life depends on the asset. For a computer, it might be three years; for a...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 4797 Depreciation