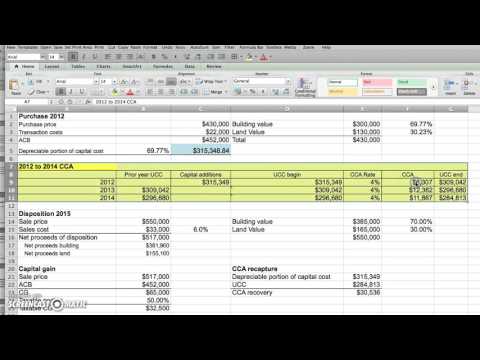

Okay, this is Mike and today we're going to look at capital gains on depreciable assets. Today, we're going to use the example of an individual who owns a building and is renting it out to tenants. The information that we have is that he is not incorporated, so all the rental income and the capital cost allowance (which is the Canada Revenue Agency term for depreciation) will be declared on the individual's personal income tax return. This individual purchased the building for four hundred and fifty-two thousand and earned rental income for three years of twenty thousand per year. At the end of year three, he disposed of the building for five hundred and seventeen thousand. So, we have three challenges: 1. Calculate the adjusted cost base (ACB) - in other words, what did the building cost us? 2. Calculate the capital gain at the sale of the building. 3. Calculate any capital cost allowance (CCA) recovery. Let's address each one of these in a step-by-step manner. The first step is to calculate our adjusted cost base (ACB). We see here that this individual paid four hundred and thirty thousand for the building and twenty-two thousand of transaction costs, for a total of 452 thousand. Now we need to know the proportion of that cost that is related to the building and the land it sits on. We don't depreciate land or take CCA on land. We've calculated that 70% of the total cost is related to the building, which gives us three hundred and fifteen thousand dollars. Now, let's calculate the capital cost allowance (CCA), which is the depreciation. The building is classified as a class 1 asset and carries a CCA rate of 4%. We start with the undepreciated capital cost (UCC) from the previous year, which is thirty-nine thousand. We...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 4797 Delete