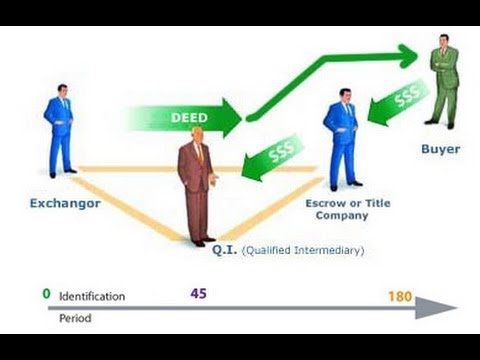

Most people are aware of the fact that when you sell a long-term investment, such as real estate or stocks, you have to pay taxes. These taxes don't usually come cheap. Currently, capital gains tax is 15%, and California has its own capital gains tax of 9.3%. To put this in perspective, if you bought a property for $500,000 and years down the line you sell the same property for $1 million, on that $500,000 profit you have to pay $121,500, plus your cost recovery recapture. That's a huge chunk of cash. But did you know there's a way you can defer that and not have to pay a single penny? It's called a 1031 tax-deferred exchange, or 1031 exchange for short. A 1031 exchange is when you sell your property and buy another like-kind property within a certain time frame and follow specific rules. Now, you have to note, this is a tax-deferred investment strategy. What that means is that you will just keep rolling over what you owe in taxes to some future date. If you ever decide to completely abandon investing in real estate altogether, you're going to have to pay it all back. The idea, though, is to continuously roll it over indefinitely until you pass away. Now that we have all that explained, let's get to how a 1031 exchange works, shall we? Let's say you bought a property ten years ago for $1 million, and today you can sell the exact same property for $2 million. The first step that needs to be taken when doing a 1031 exchange is the process of finding a good qualified intermediary, or a QI. A QI is a company that will be the middleman throughout the entire 1031 exchange process. My first tip on this: do not shop around...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 4797 Concise