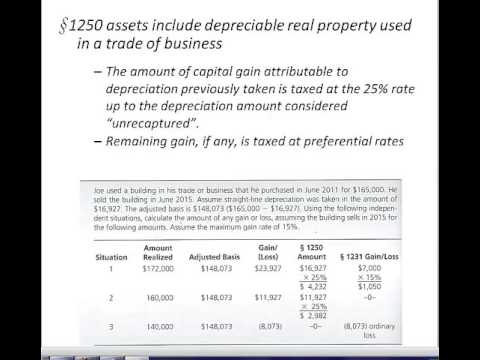

This review is for depreciation recapture provisions on page 7-21 of your text. Recall that business assets are considered Code section 1231 property. So, these assets are broken down into land, which is not depreciable, making it a pure section 1231 asset. Personal property like equipment, furniture, and computers are considered section 1245 property and are depreciated. Real estate and other rental property fall under Section 1250 and are also depreciated. When we sell section 1245 and section 1250 assets, we have to be mindful of the depreciation recapture provisions. When we sell assets, some of the gains may receive preferential tax treatment or lower tax rates. Gains on depreciated property like section 1245 and section 1250 assets occur because as an asset is depreciated, its basis gets lower and lower. So, if there is a gain on section 1245 or section 1250 assets, some of it may be due to the depreciation lowering the basis of the asset. Since businesses have already benefited from taking depreciation on assets as an expense year after year, the IRS does not want businesses to receive another tax benefit by getting preferential tax treatment on gains due to depreciation. Therefore, we have to look at section 1245 and section 1250 gains first. Section 1245 assets are personal trade or business property subject to depreciation, such as equipment, furniture, and fixtures. Any gain on the sale of section 1245 assets in excess of depreciation receives preferential tax treatment or capital gain rates, which are lower than ordinary tax rates. The gain on the amount of depreciation is taxed at regular or ordinary rates, and this is called depreciation recapture, which does not receive special tax treatment. Let's examine an example provided on page 7-17 of your text. On May 1st, 2013, Jason purchased equipment costing $12,000 for his...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 4797 Comments