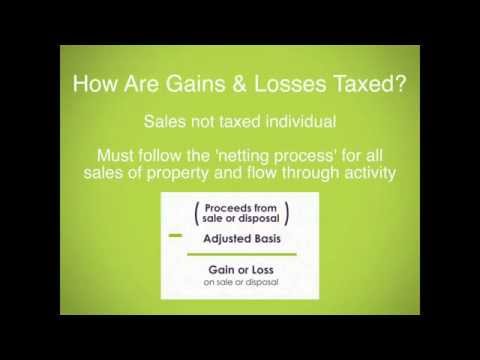

How does this gain or loss affect your taxes? Well, you can't really say on an individual basis. Meaning, if you're looking at one property you sold, unless that's the only property or item you sold for the year. That's because of the netting rules for all gains and losses. In addition to just actual assets that you own and sell, included in the netting process is amounts that flow through to you through activity like in mutual funds or retirement plans, partnership, or other types of investments. So, it's very common to see capital gains flow through for the netting process. There are two major categories. First is business use assets and second is capital asset. For the business use assets, these are items that you use to earn income. These would be common for you to have if you're self-employed. Now, capital assets include most other assets that people own. And within this category, there are two types because of different rules. The first is personal use assets which is your home, your cars, household furnishings, collectible items, boats, toys, etc. The second category is investment assets and these are items that are held for investment like stocks and bonds. But note that this does not include the business use asset and rental homes have their own specific rules that I talked about in another video. The IRS provides a list of what is not capital assets, specifically because there are so many items that are included in this category. So, if you hold items to resell to customers, that's actually considered inventory for your business and there are very specific rules for that as well and it is not included in the gain or loss calculation. The first criteria in calculating the netting process is based on...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 4797 Calculator